If you’re scouring the stock market for hidden gems, CNXA stock might already be on your radar. But what exactly makes it stand out in a sea of ticker symbols? With investors constantly seeking that sweet spot of profitability and growth, CNXA stock has gained some attention. Whether you’re a seasoned trader or a beginner itching to make a move, understanding the nuances of this stock is key to making an informed decision. Let’s break it all down and see what’s behind the buzz.

What Is CNXA Stock?

CNXA stock represents the shares of Connexa Technology Inc., a forward-thinking company dabbling in innovative solutions across multiple industries. Focused on technology-driven products, the company has its fingers in several pies, including artificial intelligence, clean energy, and digital infrastructure.

But why should you care about CNXA stock? Here’s what makes it intriguing:

- Growth Potential: Connexa Technology operates in high-demand sectors, which often spell opportunity for growth.

- Innovation Focus: Companies pushing the envelope on innovation tend to outperform in the long run.

- Attractive Valuation: Compared to its industry peers, CNXA stock might offer an appealing entry point for investors.

With these factors in mind, let’s peel back the layers and look deeper.

Why CNXA Stock Is Catching Eyes

1. Riding the Tech Boom

Technology stocks have been on fire over the past few years. Companies focusing on AI, renewable energy, and cloud-based solutions have become Wall Street darlings. Connexa Technology’s portfolio positions it to benefit from these lucrative trends.

- AI Integration: The global artificial intelligence market is forecast to grow exponentially, and Connexa’s AI-driven projects place it firmly in this growth story.

- Renewable Energy: With governments worldwide pushing green initiatives, CNXA’s clean energy ventures align with global priorities.

- Digital Expansion: Their focus on building scalable digital infrastructures caters to industries modernizing their operations.

Investors gravitate toward companies in sync with global megatrends. CNXA stock rides this wave, attracting attention from both retail and institutional investors.

2. Underdog Potential

Investors love a good underdog story. CNXA stock isn’t a household name like Tesla or Google, but that’s part of its charm. Smaller, under-the-radar companies often yield outsized returns compared to their larger counterparts.

- Smaller Market Cap: This means more room for growth.

- Early-Mover Advantage: Investing in smaller stocks early can sometimes be the secret sauce to huge returns.

Sure, there are risks—we’ll discuss those soon—but the upside potential is what keeps people intrigued.

Risks to Consider Before Investing

Like any stock, CNXA stock isn’t without its share of risks. Before jumping in with both feet, let’s take a step back and examine potential pitfalls:

- Market Volatility: Tech stocks are known for their roller-coaster ride in the market. CNXA is no exception.

- Unproven Track Record: As a relatively smaller player, Connexa hasn’t fully established itself in its sectors.

- Competition: Industries like AI and clean energy are saturated with big-name competitors. CNXA must deliver exceptional results to stand out.

Still, these risks don’t necessarily spell doom. For risk-tolerant investors, they could signal an opportunity to buy in at a discount.

Analyzing CNXA Stock’s Performance

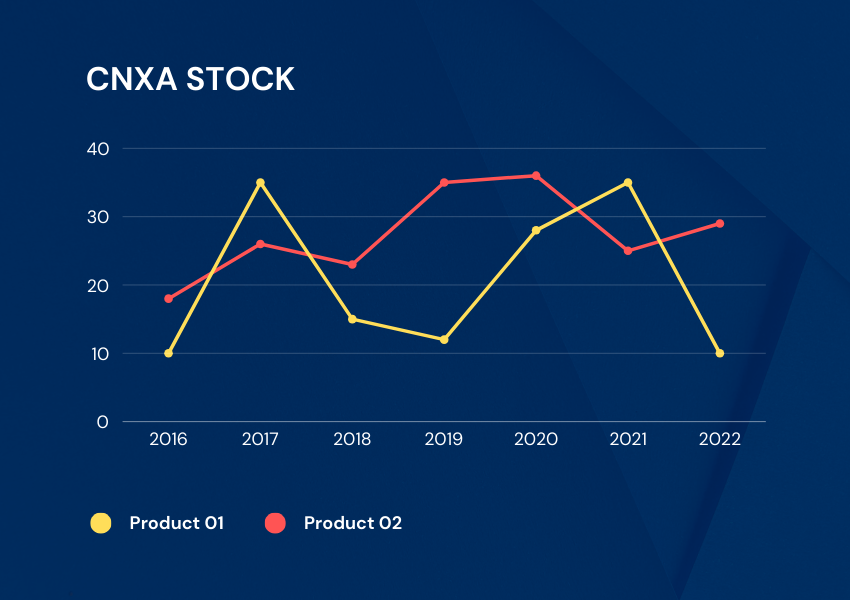

When evaluating a stock, numbers don’t lie. So, how does CNXA stock stack up? While performance metrics fluctuate, here are some key aspects worth keeping an eye on:

- Revenue Growth: Quarterly and annual revenue figures indicate whether the company is scaling effectively.

- Earnings Reports: Keep tabs on Connexa’s profitability and how it’s managing costs.

- Stock Price Movement: Has CNXA stock shown resilience during market downturns? Consistency matters.

- Industry Comparisons: How does CNXA’s performance compare to its competitors? Benchmarks provide context.

By crunching these numbers, investors can get a clearer picture of the stock’s overall health and trajectory.

Tips for Investing in CNXA Stock

If you’re considering adding CNXA stock to your portfolio, here are a few tips to make the process smoother:

- Do Your Homework: Research the company’s leadership, financial statements, and future plans.

- Set Clear Goals: Are you investing for short-term gains or long-term growth? Your strategy matters.

- Follow News Updates: Stay updated on Connexa’s developments and market conditions.

- Consult Experts: If you’re unsure, seek advice from financial professionals.

Investing isn’t just about gut feelings; it’s about being informed and strategic.

FAQs About CNXA Stock

1. Is CNXA stock a good investment?

That depends on your investment goals. If you’re comfortable with some risk and believe in the company’s growth sectors, CNXA stock could be worth exploring.

2. What industries does Connexa Technology operate in?

Connexa is involved in artificial intelligence, renewable energy, and digital infrastructure, making it a diverse tech player.

3. How can I buy CNXA stock?

You can purchase CNXA stock through most online brokerage platforms. Simply search for its ticker symbol and place an order.

4. What are the risks of investing in CNXA stock?

The main risks include market volatility, competition, and the company’s relatively unproven track record in its industries.

5. What’s the outlook for CNXA stock in 2024?

While predicting stock movements is tricky, continued focus on AI and clean energy could bolster CNXA’s prospects.

Conclusion

CNXA stock offers a unique mix of potential and risk, appealing to investors who enjoy rolling the dice on emerging opportunities. With its foothold in high-growth industries and a focus on innovation, Connexa Technology has plenty of upside—but it’s not without challenges. Whether you choose to invest or take a wait-and-see approach, one thing’s clear: CNXA stock is one to watch.

So, what’s your take on CNXA stock? Are you ready to dive in, or is it staying on your watchlist for now? Either way, keeping a close eye on this underdog might just pay off down the line!